At Crosby Land Company, we are outdoorsmen and women. We cherish time spent outdoors and recognize that as more people invest in rural properties for recreation, legacy, or lifestyle, conservation-minded landowners need to make smart decisions. With conservation easements, landowners are able to preserve local cultural heritage and communities that are being impacted by urban sprawl, as well as protect water quality and ensuring clean air for future generations.

If you’re considering purchasing conservation land or already own acreage you want to protect, this guide will walk you through how easements work, their financial advantages, and how they’re used specifically in South Carolina and Georgia.

What is a Conservation Easement?

A conservation easement is a voluntary legal agreement between a landowner and a qualified conservation organization such as a land trust. This agreement permanently limits certain types of development or land use in order to protect the property’s natural, scenic, agricultural, or historical resources.

Things to Remember:

- You still own the land.

- You can still sell or pass it down to heirs.

- You decide which rights are retained and which are restricted.

The land stays private, but is protected from fragmentation, which is one of the biggest threats we face. In areas like the Lowcountry of South Carolina, that’s music to our ears.

Why Consider a Conservation Easement?

For many landowners, conservation easements offer the best of both worlds: preserving what makes a property special while unlocking financial benefits and ensuring long-term stewardship.

Top Reasons to Consider a Conservation Easement:

- Protect Legacy: Prevent unwanted development and preserve wildlife habitat, forests, farmland, or wetlands.

- Maintain Private Use: Continue to use the land for hunting, fishing, farming, timber, or recreation.

- Preserve Property Value: Conservation land often holds its value over time and appeals to like-minded buyers.

- Access Financial Incentives: Qualify for federal tax deductions, state tax credits (in GA and SC), and potentially lower estate taxes.

How Conservation Easements Work in South Carolina and Georgia

Both South Carolina and Georgia have active land conservation programs and strong legal frameworks for easements. Here’s what to know as a landowner in either state:

In South Carolina:

- Conservation easements are recognized under state law and commonly used to protect Lowcountry marshlands, timber tracts, farms, and historical properties.

- The South Carolina Conservation Bank provides funding to assist land trusts in purchasing easements from willing landowners.

-

Easements benefit the public by protecting our rivers and streams that provide clean water and our sustainable forest that provide clean air.

- The land can still be used for traditional practices like hunting, agriculture, or timber production.

In Georgia:

- Georgia’s Land Conservation Program helps fund and promote easements on working lands, forests, and wildlife corridors.

- The Georgia Department of Natural Resources and land trusts like the Georgia-Alabama Land Trust are active participants.

- Conservation easements are commonly used to preserve mountain tracts, riverfront land, farmland, and pine timberlands.

Financial Benefits of a Conservation Easement

Perhaps one of the most compelling reasons to explore a conservation easement is the financial upside. Landowners who donate a qualifying conservation easement may be eligible for:

1. Federal Income Tax Deduction

The IRS allows a charitable deduction based on the appraised value of the development rights you’ve given up.

- The donation must meet the IRS’s definition of “qualified conservation contribution.”

- Deduction limit: up to 50% of adjusted gross income (AGI), with a 15-year carryforward.

- Qualified farmers and ranchers may deduct up to 100% of AGI.

2. State Tax Credits

South Carolina:

- Offers a state income tax credit of 25% of the value of the donated easement, capped at $250,000 per taxpayer.

- Credits can be carried forward for up to 10 years and are transferable (they can be sold).

Georgia:

- Offers a state income tax credit of 25% of the fair market value of the donated easement, up to $500,000 for individuals and $1 million for corporations.

- Credits are transferable and can be carried forward for up to 10 years.

3. Reduced Property and Estate Taxes

Because the easement lowers the development potential of the land, its appraised value may be reduced—leading to:

- Lower property taxes in some jurisdictions

- Significantly lower estate tax liability for heirs

What Can You Still Do With Conservation Land?

One of the biggest misconceptions about conservation easements is that they “lock up” the land. In reality, most easements are written to preserve the landowner’s way of life while removing only the most intensive development rights.

Landowners often retain the right to:

- Hunt, fish, and enjoy recreational use

- Farm or graze livestock

- Manage timber under sustainable forestry practices

- Build or maintain homes or structures (depending on the terms of the easement)

- Sell the land or pass it down to heirs

Each easement is customized, so you can protect what matters most and maintain the use that makes sense for your lifestyle. Crosby Land Company offers land services that can help you prioritize what you need and desire from your land ownership and help you make the right decisions when it comes to conservation.

Steps to Establish a Conservation Easement

- Find a Qualified Land Trust or Agency

Partner with a trusted organization like Ducks Unlimited, The Nature Conservancy, or a regional land trust. - Evaluate Your Land’s Conservation Value

They’ll assess your property’s ecological, historical, agricultural, or scenic features. - Define the Easement Terms

You’ll work with the land trust and your attorney to draft restrictions that align with your goals and qualify for tax benefits. - Obtain a Qualified Appraisal

The easement’s value is determined by subtracting the post-easement value from the land’s original appraised value. - Complete Legal & Tax Filings

Once signed, the easement is recorded in the county’s public records. Tax documentation is submitted for deduction/credit eligibility. - Monitor & Stewardship

The land trust will periodically monitor the land to ensure the terms are upheld. This is usually non-intrusive and collaborative.

Is a Conservation Easement Right for You?

You may want to explore this option if:

- You want to preserve your land for future generations.

- You own property with significant natural, agricultural, or scenic features.

- You’re seeking federal or state tax relief.

- You want to reduce the estate tax burden for your heirs.

- You value privacy and limited development.

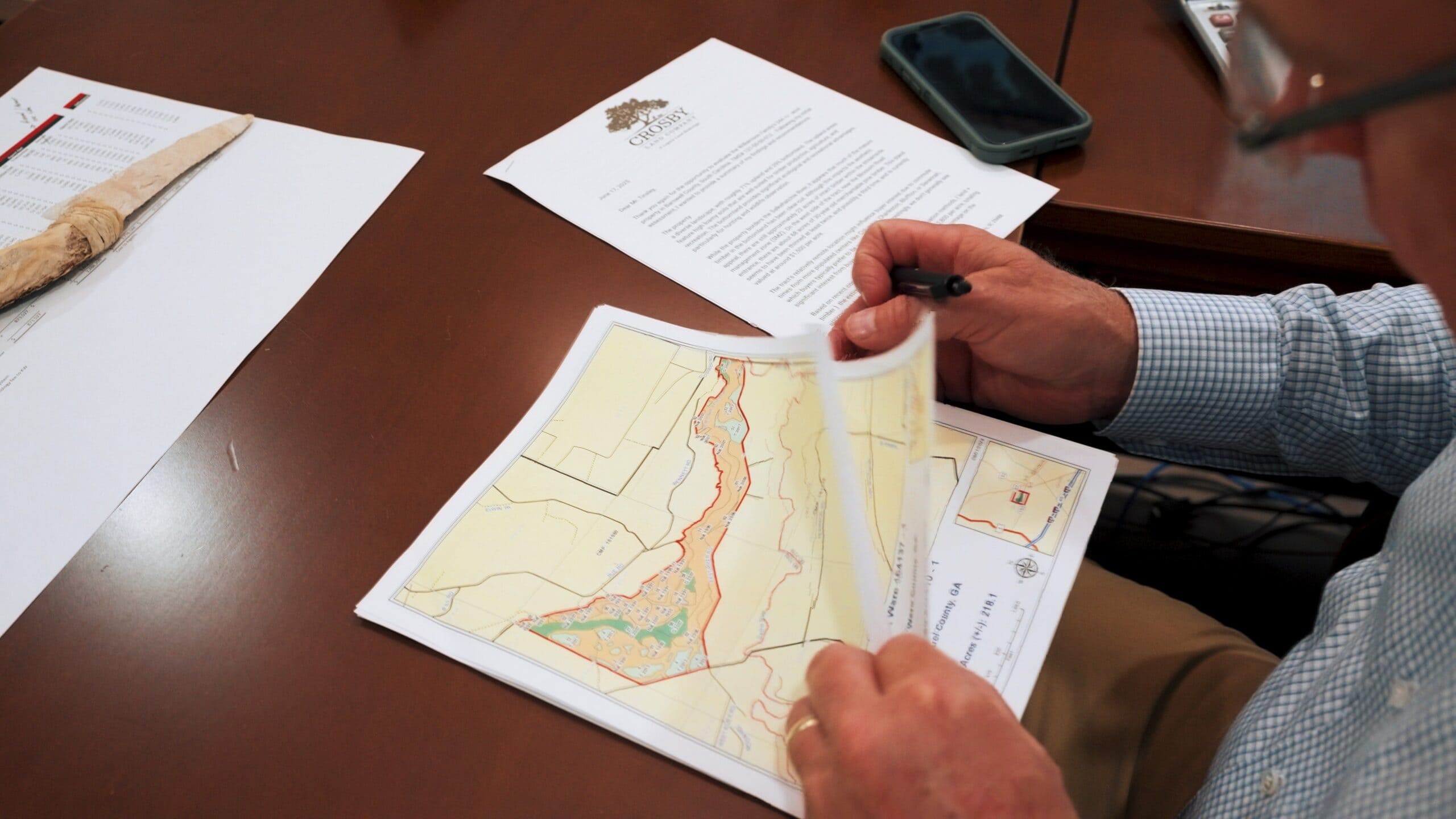

Real-World Examples

Example 1: Family Farm in South Carolina

A multi-generation family farm near Charleston placed a conservation easement on 500 acres of farmland and woodland. They continued to farm, hunt, and timber the land while receiving a sizable state tax credit and ensuring that the land can’t be sold off in parcels or developed.

Example 2: Recreational Tract in Georgia

A landowner in Middle Georgia purchased 300 acres of mixed pine and hardwood forest for deer and turkey hunting. They worked with a land trust to preserve the tract’s natural features and received both a federal tax deduction and a $400,000 Georgia state tax credit (which they sold for cash flow).

Whether you’re protecting a family farm, a timber tract, or your dream recreational property, a conservation easement can be one of the most powerful tools to both protect land and preserve value.

In South Carolina and Georgia, landowners are uniquely positioned to take advantage of favorable programs that reward stewardship and protect the landscapes that make this region special. As you evaluate conservation land or explore new properties, consider the long-term potential a conservation easement can offer.

Looking for land with conservation potential—or considering protecting the land you already own? Let our team help guide you through the process and connect you with the resources you need to leave a legacy that lasts.